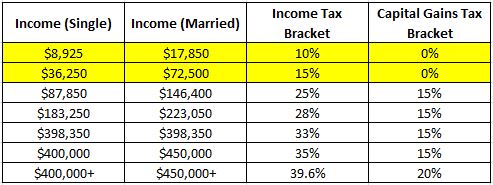

Generally, at the federal level, long-term capital gains receive more favorable tax treatment than short-term gains.Ĭapital gains are not taxed until they are realized, meaning that even if your Apple stock has increased 50x from the day you invested, you won’t owe any capital gains taxes until you sell the stock. Long-term capital gains: These are gains from selling assets that you’ve held for more than one year.At the federal level, short-term capital gains are typically taxed at the same (high) rate as ordinary income. Short-term capital gains: These are gains from selling assets that you’ve held for one year or less.

There are two types of realized capital gains for taxation purposes: Critically for our purposes, in most cases you will not pay taxes until you cash out or “realize” the gains.

For instance, if you hold stock that increases in value, but you haven’t sold it yet, that is considered an unrealized capital gain. Unrealized gains, by contrast, represent a change in the value of an investment that you have not yet sold. “Realized” in this context means “acquired” or “received,” so realized capital gains are gains that you have captured by selling the asset. Capital assets can include stocks, real estate, or even an item purchased for personal use like a car or a boat – in short, any significant property that could gain or lose value over time.Ĭapital gains can be realized or unrealized. So let’s dive in! What Are Capital Gains?Ĭapital gains are a capital asset’s increase in value from the value at which it was purchased. But how much? It’s important to understand your capital taxes and how they will impact your financial future, not least because that knowledge will empower you to take action to reduce your tax bill today. If you have cashed out capital gains in Montana, you know you’ll lose something to taxes.

0 kommentar(er)

0 kommentar(er)